Seniors And Disabled Encouraged to Apply for Tax Rebate Programs

Published on January 03, 2024

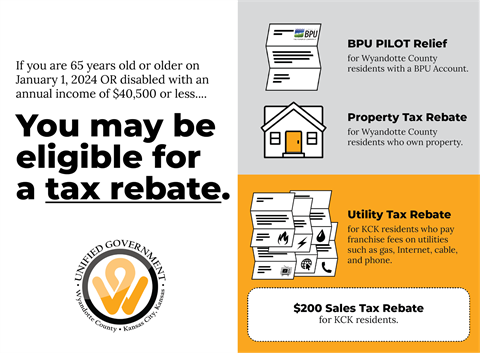

As of January 2, 2024, many Wyandotte County and Kansas City, Kansas seniors or persons living with a disability can verify their eligibility for BPU PILOT Relief, property tax refund, utility, and sales tax rebate programs. The tax rebate application process will take place from through Monday, April 15. The Unified Government (UG) officially launched community outreach to help applicants apply for tax rebates on their utilities and homes.

Applicants can call 3-1-1 (913-573-5311) to make an appointment to present their paperwork and complete applications at any of the available locations throughout the week. Free transportation may also be available to their appointment with at least 48-hour notice.

There have been some changes to the tax rebate programs from the State of Kansas this year and the Unified Government has posted updated qualifications and documentation requirements on their website at wycokck.org/taxrebates.

BPU PILOT Relief and Property Tax Rebate Program: Wyandotte County residents with an income of $40,500 or below and who will be sixty-five or disabled on January 1, 2024, may be eligible to qualify for a refund of the BPU PILOT charges if they are a BPU customer or a portion of their property taxes as a property owner.

Utility and Sales Tax Rebate Program: Residents living in Kansas City, Kansas who are at-least age sixty-five or disabled on January 1, 2024, with an income of $40,500 or below may be eligible for this program to receive a rebate on franchise fees collected on gas, Internet, cable, or phone bills. The 2023 sales tax rebate, for eligible applicants, is $200.

Documents Needed to Verify Eligibility

Your contact information (full name, complete home address, date of birth and telephone number). If you want your check mailed to a different address, please provide the mailing address and mark separately as your preferred mailing address.

If disabled, the date of disability and from what agency (i.e. Social Security, Railroad, Veterans Administration).

Proof of income for all persons living in your home for all of 2023. Documents accepted are:

- W-2, 1099

- Social Security statement (received at the beginning of the year showing how much you received for the previous year {usually has pink boxes with total amounts on the form})

- Railroad retirement statement

- Veteran's disability statement

- Bank interest statements

- Food stamp award

- Child support income

How to Apply

By Mail

Interested applicants may mail their eligibility documents to the UG Clerk’s Office for review (Office of the Clerk, 701 N 7th Street, Suite 323, Kansas City KS 66101). All documents will be returned once fully reviewed.

In-Person

To ensure residents fully understand the application process and document requirements, the Unified Government will host one-on-one appointments starting Tuesday, January 2 through Monday, April 15 to help answer any questions and walk residents through their applications.

Appointments will be available at the following community centers and business locations throughout Wyandotte County and Kansas City, Kansas:

- City Hall, Office of the Clerk – 3rd Floor (Monday - Friday), 8:30AM – 4PM

- Area Agency on Aging (Tuesdays), 9AM – 1PM

- Argentine Community Center (Wednesdays/ 1st & 3rd Weeks), 9AM – 12PM

- Turner Recreation Center (Wednesday/ Once Monthly), 11AM – 2PM

- Eisenhower Community Center (Thursdays), 9AM – 12PM

- KCK Annex Building (Fridays), 8:30AM – 4:30PM

Learn more.

For more information regarding the tax rebate programs, document requirements and appointment locations, please visit our website at wycokck.org/taxrebates or call 3-1-1 (913-573-5311).